Ooredoo Money Qatar: Register, Fees, Card, Send & Receive

Ooredoo Money Qatar is a versatile mobile wallet service that revolutionizes the way you manage your finances, make payments, and transfer money both locally and internationally. This comprehensive guide will walk you through everything you need to know about Ooredoo Money, from registration to its wide range of services and features.

What is Ooredoo Money?

Ooredoo Money, also known as Ooredoo Mobile Money (OMM), is a virtual account linked to your Ooredoo mobile number in Qatar. It serves as a digital wallet that allows you to deposit, access, and withdraw money using your mobile phone. The service provides a secure and convenient way to manage finances, send money locally and internationally, and make various payments.

Key Features of Ooredoo Money

- Mobile Wallet: A virtual account tied to your Ooredoo mobile number

- Money Transfers: Local and international money transfer services

- Bill Payments: Pay for various services and utilities

- Mobile Top-ups: Recharge prepaid mobile accounts

- Cash Deposits and Withdrawals: Manage your funds through various channels

- Secure Transactions: Protected by a 4-digit mPIN

Getting Started with Ooredoo Money

How to Register

Registering for Ooredoo Money is a straightforward process:

- Eligibility: Ensure you have a valid QID and an Ooredoo number registered under your name.

- Registration Methods:

- Download and use the Ooredoo Money App

- Dial *140# and follow the prompts

- Use the Smart menu by dialing *100#

- Set up mPIN: Create a secure 4-digit mPIN to protect your account

- Visit an Ooredoo store: Complete the registration process by visiting an Ooredoo store for verification

Requirements for Registration

- Valid Qatar ID (QID)

- Ooredoo mobile number registered in your name

- Smartphone (for app-based registration)

Wallet Types and Limits

Ooredoo Money offers two types of wallets: Basic and Full. Here’s a comparison of their transaction limits:

Full Wallet Limits

| Transaction Type | Daily Limit (QR) | Monthly Limit (QR) |

|---|---|---|

| Transfer and Payments | 25,000 | 30,000 |

| Cash In | 30,000 | 30,000 |

| Wallet Balance | 30,000 | N/A |

Basic Wallet Limits

| Transaction Type | Daily/Monthly Limit (QR) |

|---|---|

| Transfer and Payments | 5,000 |

| Cash In | 5,000 |

| Wallet Balance | 5,000 |

To upgrade from a Basic to a Full Wallet, visit any Ooredoo Shop or Star Link outlet with your original QID.

Ooredoo Money Services

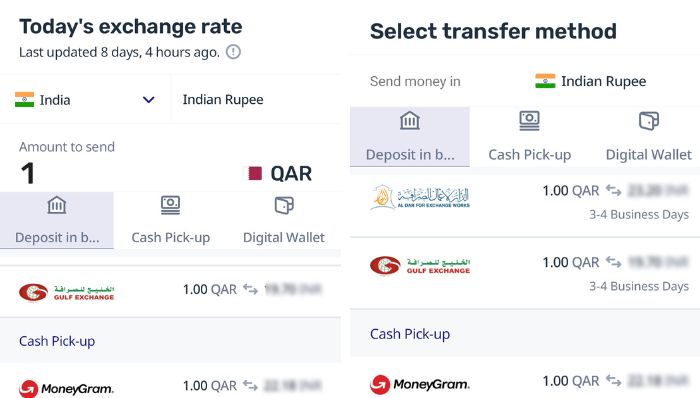

International Money Transfers

Ooredoo Money offers international money transfer services through partnerships with MoneyGram and various exchange houses.

- Simple process: Dial *140# and follow the menu options

- 24/7 availability: Send money anytime, day or night

- Quick transfers: Cash arrives in 10 minutes to 200 countries through MoneyGram

- Competitive rates: Offers one of the best exchange rates with competitive fees

How to Send Money Internationally

- Access the Ooredoo Money menu

- Select “International Transfer”

- Choose the recipient country

- Enter the amount to send

- Review and confirm the transaction details

- Enter your mPIN to authorize the transfer

Sending Money to Bank Accounts via MoneyGram

Ooredoo Money allows users to send money directly to bank accounts in India and other countries through MoneyGram. This service provides an additional layer of convenience for recipients who prefer direct bank deposits.To use this service:

- Select “Send to Bank Account” in the international transfer menu

- Choose the recipient country

- Select the recipient’s bank

- Enter the recipient’s bank account details

- Complete the transaction as usual

Mobile Wallet Transfers to Africa

For users sending money to African countries, Ooredoo Money offers the option to transfer funds directly to mobile wallets in Kenya and selected African nations via MoneyGram. This service enhances the reach and convenience of international transfers for recipients in these regions.

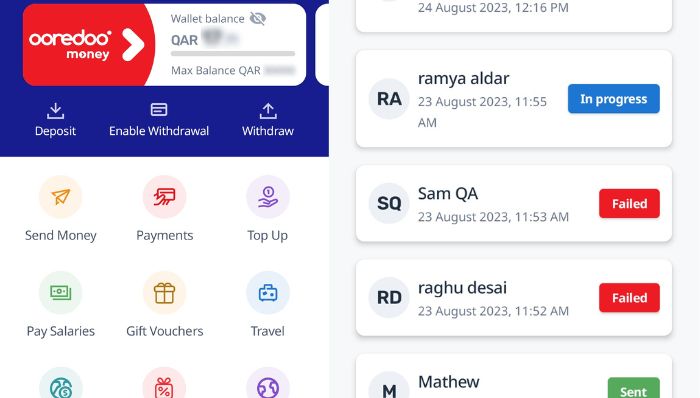

Local Money Transfers

Ooredoo Money facilitates quick and easy money transfers within Qatar. Users can send money to any Ooredoo subscriber in the country instantly.

- Access the Ooredoo Money menu

- Select “Local Transfer”

- Enter the recipient’s Ooredoo mobile number

- Enter the amount to send

- Confirm the transaction details

- Enter your mPIN to complete the transfer

Bill Payments and Top-ups

Ooredoo Money simplifies bill payments and mobile top-ups for users in Qatar. This service allows you to manage various payments from your mobile wallet.

Services Available for Payment

- Ooredoo Hala (prepaid) top-ups

- Ooredoo Shahry (postpaid) bill payments

- Utility bill payments (electricity, water, etc.)

- Other service provider payments

How to Pay Bills or Top-up

- Access the Ooredoo Money menu

- Select “Bill Payment” or “Top-up”

- Choose the service provider or bill type

- Enter the account number or mobile number

- Enter the payment amount

- Confirm the transaction details

- Enter your mPIN to complete the payment

Cash Deposits and Withdrawals

Ooredoo Money provides flexible options for managing your funds through cash deposits and withdrawals.

Cash Deposits

Users can add money to their Ooredoo Money wallet through various channels:

- Ooredoo shops

- Authorized agents

- QNB ATMs (for QNB account holders)

- Ooredoo Self Service Machines (SSM)

Cash Withdrawals

Withdrawing cash from your Ooredoo Money wallet is convenient and accessible:

- QNB ATMs: Withdraw cash from any QNB ATM in Qatar

- Ooredoo shops: Visit any Ooredoo shop for cash withdrawals

- Authorized agents: Some agents may offer cash-out services

Domestic Worker Salary Payments

Ooredoo Money offers a convenient feature for paying salaries to domestic workers in Qatar. This service ensures quick, easy, and reliable salary transfers.

- Convenient: Pay salaries directly from your mobile wallet

- Traceable: Keep a record of all salary payments

- Secure: Eliminate the need for cash transactions

How to Use the Domestic Worker Salary Payment Feature

- Access the Ooredoo Money menu

- Select “Domestic Worker Salary Payment”

- Enter the worker’s details and salary amount

- Confirm the transaction details

- Enter your mPIN to complete the payment

International Top-ups

Ooredoo Money has introduced an “International Top-Up” service, allowing users to recharge mobile and entertainment services for family and friends abroad.

- Wide coverage: Top-up services available for multiple countries

- Various services: Includes mobile recharges and entertainment service top-ups

- Instant credit: Recipients receive the top-up immediately

How to Use International Top-up Service

- Access the Ooredoo Money menu

- Select “International Top-up”

- Choose the country and service provider

- Enter the recipient’s number or account details

- Select the top-up amount

- Confirm the transaction details

- Enter your mPIN to complete the top-up

Ooredoo Money App

The Ooredoo Money App is a free mobile application that provides a user-friendly interface for accessing all Ooredoo Money services. It offers enhanced features and convenience compared to the USSD-based service.

Key Features of the Ooredoo Money App

- User-friendly interface

- Quick access to all Ooredoo Money services

- Transaction history and account management

- Enhanced security features

- Real-time notifications for transactions

How to Download and Install the App

- Visit the App Store (iOS) or Google Play Store (Android)

- Search for “Ooredoo Money”

- Download and install the app

- Open the app and follow the registration process if you’re a new user, or log in with your existing credentials

Security Measures

- mPIN Protection: All transactions require a 4-digit mPIN known only to the user

- Encrypted Transactions: All data transfers are encrypted to prevent unauthorized access

- Fraud Detection: Advanced systems to detect and prevent fraudulent activities

- Account Monitoring: Real-time monitoring of account activities

- One-Time Password (OTP): Additional security for adding new beneficiaries through the app

Fees and Charges

Ooredoo Money services come with various fees and charges depending on the type of transaction. Here’s an overview of the common fees:

| Service | Fee |

|---|---|

| Registration | Free |

| Cash In (various methods) | Free |

| Convenience fee for Cash In via Debit Card | QR 3 |

| DPS School Fee Payment | QR 10 |

| Karwa SmartCard top-up | Free |

| Domestic Workers Salary Payment | QR 10 |

| Hala Top-Up | Free |

| Bill Payment | Free |

| Cash Out via Ooredoo Shop | QR 4 |

| Cash Out via QNB ATM | QR 3 |

| Local Transfer to Banks (including QNB Mobile Pay) | QR 4 |

| Annual Maintenance fee* | QR 30 |

*The annual maintenance fee is waived if the customer completes at least 1 International Money Transfer OR 12 ITU/Ooredoo Services/any payment transactions in a calendar year via Ooredoo Money.

International Transfer Fees

International transfer fees start from QR 20 and vary based on the receiving country and transaction amount. Users are advised to check the transfer fee and exchange rate before confirming the transaction.

Local Transfer Fees

Local transfer fees for wallet-to-wallet transactions are tiered based on the transfer amount:

| Amount Range (QR) | Fee (QR) |

|---|---|

| 1-100 | 2 |

| 101-200 | 3 |

| 201-500 | 5 |

| 501-1000 | 7 |

| 1001-4000 | 9 |

| 4001-7000 | 11 |

| 7001-10000 | 13 |

Promotions and Referral Program

Ooredoo Money frequently offers promotions and a referral program to incentivize usage and attract new customers.

Promo Codes

Users can apply promo codes during international transfers to receive special discounts on fees. These promotions are typically time-limited and subject to terms and conditions.

Referral Program

Ooredoo Money encourages users to refer friends and family to the service. After completing an international transfer, users can enter the mobile number of the person who referred them. Referrers may receive rewards for successful referrals.

Transaction Limits and Restrictions

Ooredoo Money has set various limits on transactions to ensure security and compliance with regulations:

MoneyGram Transaction Limits

- Number of transactions per day per sender: 5

- Number of transactions per week per sender: 15

- Number of transactions per month per sender: 15

- Number of Beneficiaries per sender per month: 7

Other Transaction Limits

- International Money Transfers: Max value QR 25,000, Daily limit QR 25,000

- Cash In from Ooredoo Machine (SSM): Max value QR 6,000, Daily limit QR 6,000

- QNB ATM Cash Out via Voucher: Max value QR 1,000, Daily limit QR 1,000

- Bill Payment: Max value QR 2,000, Daily limit QR 4,000

- Hala Top Up: Max value QR 500, Daily limit QR 4,000

Customer Support

For any queries, issues, or support related to Ooredoo Money, users can access customer support through various channels:

- Ooredoo Shops: Visit any Ooredoo shop for in-person assistance

- Customer Service Hotline: Call 111 for dedicated Ooredoo Money support

- Online Support: Access FAQs and support resources on the Ooredoo website

- In-App Support: Use the help and support features within the Ooredoo Money App

Frequently Asked Questions

- Can I use Ooredoo Money if I’m not an Ooredoo customer?

Yes, you can use any Qatar Mobile number to register and use the Ooredoo money. - How long does an international transfer take?

Most international transfers are completed within 10 minutes, but processing times may vary depending on the destination country and transfer method. - Is there a limit to how much money I can send internationally?

Yes, there are daily and monthly limits for international transfers. These limits may vary based on your account type and verification level. - Can I cancel a transfer after it’s been sent?

Once a transfer is initiated, it cannot be canceled. Always double-check the details before confirming a transaction. - How do I reset my mPIN if I forget it?

You can reset your mPIN through the Ooredoo Money App or by visiting an Ooredoo shop with your QID for verification.

Ammara Abdullah is an experienced writer and editor specializing in technology and digital trends. With over 5 years of experience, she produces insightful articles on emerging tech, consumer electronics, and digital culture. Ammara holds a degree in journalism and is passionate about making complex topics accessible to readers.