PayPal Qatar: Your Guide to Using PayPal in the Gulf State

PayPal is available in Qatar, allowing users to send and receive payments online. However, withdrawals require a QNB Bank account. Qatar residents can create PayPal accounts on the official website and link local bank accounts or cards for transactions.

What is PayPal?

PayPal is a leading online payment system that facilitates secure electronic transactions worldwide. In Qatar, PayPal serves as a convenient platform for individuals and businesses to send and receive money, make online purchases, and conduct international transactions.

Key Features of PayPal in Qatar

- Online payments

- Money transfers

- Secure transactions

- Multiple currency support

- Integration with e-commerce platforms

Benefits of Using PayPal in Qatar

- Enhanced security for online transactions

- Convenient international payments

- Buyer and seller protection

- Easy integration with online businesses

- Access to a global marketplace

PayPal Availability in Qatar

PayPal is indeed available for use in Qatar, offering a range of services to both individual and business users. However, it’s important to note that while PayPal can be used for sending and receiving payments, there are some limitations specific to Qatar.

Services Available in Qatar

- Creating a PayPal account

- Sending money internationally

- Receiving payments

- Making online purchases

- Integration with e-commerce platforms

PayPal Limitations in Qatar

- Withdrawal restrictions

- Limited local bank integration

- Currency conversion fees

How to Open a PayPal Account in Qatar

Opening a PayPal account in Qatar is a straightforward process. Follow these steps to create your account:

Step-by-Step Guide

- Visit the official PayPal Qatar website (www.paypal.com/qa)

- Click on the “Sign Up” button

- Choose between a Personal or Business account

- Enter your email address and create a strong password

- Provide your personal information (name, address, phone number)

- Verify your email address

- Link a payment method (credit card, debit card, or bank account)

Required Documents

To successfully open and verify your PayPal account in Qatar, you’ll need:

- Valid email address

- Mobile phone number

- Government-issued ID (passport or national ID)

- Proof of address (utility bill or bank statement)

- Bank account or credit/debit card information

Account Verification Process

After creating your account, PayPal may require additional verification:

- Email verification: Click the link in the confirmation email

- Phone verification: Enter the code sent to your mobile number

- Identity verification: Upload a copy of your government-issued ID

- Address verification: Provide a recent utility bill or bank statement

Using PayPal in Qatar

Once your account is set up, you can start using PayPal for sending money, receiving payments, making online purchases, and currency conversion in Qatar.

Do not use VPN to access the PayPal account in Qatar. It can result in your account being closed.

Sending Money

To send money using PayPal in Qatar:

- Log in to your PayPal account

- Click “Send & Request”

- Enter the recipient’s email address or mobile number

- Specify the amount and currency

- Choose the funding source (PayPal balance, bank account, or card)

- Review and confirm the transaction

Receiving Payments

To receive money through PayPal in Qatar:

- Provide your PayPal email address to the sender

- Wait for the payment notification

- Log in to your account to confirm the received funds

- Choose to keep the money in your PayPal balance or transfer it to your linked bank account

Making Online Purchases

Using PayPal for online shopping in Qatar:

- Shop on websites that accept PayPal

- Select PayPal as your payment method at checkout

- Log in to your PayPal account

- Review the transaction details

- Confirm the payment

Currency Conversion

PayPal supports multiple currencies, but keep in mind:

- Transactions in Qatar are typically processed in USD

- Currency conversion fees may apply when receiving payments in foreign currencies

- You can hold balances in multiple currencies within your PayPal account

Withdrawing Money from PayPal in Qatar

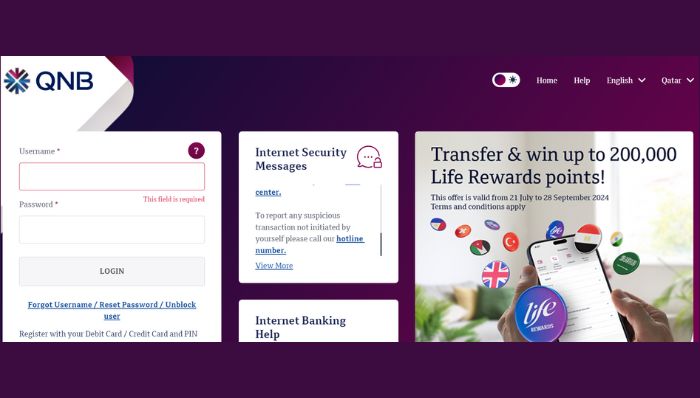

Qatar National Bank (QNB) is currently the only bank in Qatar offering direct integration with PayPal for withdrawals.

Steps to Set Up QNB Withdrawal

- Log in to QNB Internet Banking

- Navigate to the PayPal section

- Click on “Withdrawal Setup”

- Enter your PayPal account ID

- Follow the prompts to link your PayPal and QNB accounts

- Verify the connection using the OTP sent to your registered mobile number

Alternative Withdrawal Methods

If you don’t have a QNB account, consider these alternatives:

- Use a Payoneer account as an intermediary

- Transfer funds to a friend or family member with a QNB account

- Use the funds for online purchases or digital services

Withdrawal Fees and Limits

Be aware of the following when withdrawing from PayPal in Qatar:

- Minimum withdrawal amount: 18.20 QAR

- Maximum withdrawal amount: 10,000 QAR per transaction

- Daily withdrawal limit: 10,000 QAR

- Withdrawal fee: 15 QAR per transaction

PayPal for Businesses in Qatar

PayPal offers various features for businesses operating in Qatar, enabling them to expand their reach and streamline online transactions.

To create a PayPal business account in Qatar:

- Visit the PayPal Qatar website

- Click “Sign Up” and select “Business Account”

- Provide your business details (name, type, contact information)

- Verify your email and phone number

- Complete the business verification process by submitting required documents

Benefits for Qatari Businesses

Using PayPal can offer several advantages for businesses in Qatar:

- Access to international markets

- Simplified online payment processing

- Integration with e-commerce platforms

- Invoicing tools

- Seller protection for eligible transactions

PayPal Merchant Services

PayPal offers various tools for businesses in Qatar:

- Payment gateway integration

- Recurring billing options

- Mass payout capabilities

- Customizable checkout experiences

- Detailed transaction reporting

Transfer Hala Credit To Another Mobile

Security and Fraud Prevention

PayPal prioritizes security for users in Qatar through various measures and best practices.

PayPal Security Features

- End-to-end encryption for all transactions

- Fraud monitoring and detection systems

- Two-factor authentication

- Seller and buyer protection policies

- Secure storage of financial information

Best Practices for Users in Qatar

To enhance your PayPal security in Qatar:

- Use a strong, unique password

- Enable two-factor authentication

- Avoid using public Wi-Fi for PayPal transactions

- Regularly monitor your account activity

- Keep your PayPal app and devices updated

Reporting Suspicious Activity

If you suspect fraudulent activity on your PayPal account in Qatar:

- Log in to your account and change your password immediately

- Contact PayPal customer support

- Review your recent transactions and report any unauthorized activity

- Consider freezing your account temporarily

Fees and Charges for PayPal in Qatar

Understanding the fee structure for PayPal transactions in Qatar is crucial for effective financial management.

Transaction Fees

| Transaction Type | Fee |

|---|---|

| Sending money (funded by PayPal balance or bank account) | Free |

| Sending money (funded by credit or debit card) | 3.4% + fixed fee |

| Receiving payments for goods and services | 3.9% + fixed fee |

| Withdrawals to QNB account | 15 QAR per transaction |

Currency Conversion Fees

When dealing with multiple currencies:

- PayPal charges a 4% fee above the base exchange rate

- Fees may vary depending on the currencies involved

- Consider holding balances in frequently used currencies to minimize conversion fees

Additional Charges

Be aware of potential additional fees:

- Chargeback fee: Varies based on the transaction currency

- Refund fee: No fee to refund a transaction, but the original transaction fee is not returned

- Account inactivity fee: None in Qatar, but keep your account active to avoid potential issues

Troubleshooting Common PayPal Issues in Qatar

Users in Qatar may encounter specific issues when using PayPal. Here are some common problems and their solutions:

Account Limitations

If your account is limited:

- Log in to your PayPal account

- Review the limitation details in your account overview

- Provide any requested information or documentation

- Wait for PayPal to review and lift the limitation

Payment Declines

If your payment is declined:

- Verify that your payment method has sufficient funds

- Ensure your card or bank account is properly linked

- Check for any restrictions on your account

- Contact your bank to authorize PayPal transactions

Withdrawal Issues

If you’re having trouble withdrawing funds:

- Confirm that your QNB account is correctly linked

- Verify that you meet the minimum withdrawal amount

- Check your daily and per-transaction withdrawal limits

- Contact QNB customer support for assistance with PayPal integrations

Alternatives to PayPal in Qatar

While PayPal is widely used, there are alternative payment methods available in Qatar:

Local Payment Solutions

- QPay: Qatar’s national payment gateway

- Ooredoo Money: Mobile wallet service

- C-Wallet: Digital payment solution

International Alternatives

- Skrill: Online payment and money transfer service

- Neteller: E-money transfer service

- Wise (formerly TransferWise): International money transfer platform

Comparison

| Feature | PayPal | QPay | Ooredoo Money | Skrill |

|---|---|---|---|---|

| International Transfers | Yes | Limited | Limited | Yes |

| Local Bank Integration | Limited | Yes | Yes | Limited |

| Currency Support | Multiple | QAR | QAR | Multiple |

| Merchant Services | Yes | Yes | Limited | Yes |

| Mobile App | Yes | Yes | Yes | Yes |

Topping Up Your PayPal Account in Qatar

There are multiple ways to add funds to your PayPal account in Qatar:

Using QNB Internet Banking

- Log in to QNB Internet Banking

- Click on “PayPal”

- Select “Top-up”

- Choose the amount you want to add (minimum 100 QAR, maximum 10,000 QAR per day)

- Confirm the transaction

Important details:

- There is a fee of 15 QAR for each top-up transaction

- Top-ups are only available in US dollars

- The funds will be instantly credited to your PayPal account

Benefits

- Instant transfer of funds

- Secure transactions through QNB’s online banking platform

- Convenient integration with your QNB account

Using Other Bank Cards

You can also top up your PayPal account using credit or debit cards from other banks:

- Log in to your PayPal account

- Click on “Add money” or “Transfer money”

- Select “Add money from a debit or credit card”

- Enter the amount you wish to add

- Choose your linked card or add a new one

- Confirm the transaction

Transaction Limits

| Transaction Type | Minimum Amount (QAR) | Maximum Amount (QAR) | Daily Limit (QAR) |

|---|---|---|---|

| PayPal Top-up | 100 | 10,000 | 10,000 |

How to Register QNB Bank Account with PayPal

To link your QNB bank account with PayPal in Qatar, follow these steps:

- Log in to QNB Internet Banking at https://ib.qnb.com/identity/login

- Navigate to the “PayPal” section in the menu

- Click on “Withdrawal Setup”

- Enter your PayPal account ID (email address) and click “Submit”

- Click on “Click here to Activate the PayPal Withdrawal Service”

- A PayPal mini-browser will appear. Enter your PayPal account password and click “Authorize to Continue”

- After authorization, click “Close and Continue”

- Return to the PayPal section on QNB Internet Banking

- Click “Continue” to complete the withdrawal setup

- An OTP (One-Time Password) will be sent to your registered mobile number

- Enter the OTP and click “Confirm”

After successfully completing these steps, your QNB bank account will be linked to your PayPal account. This linkage allows you to:

- Withdraw funds from your PayPal account to your QNB account

- Set up standing orders for automated withdrawals

- Top up your PayPal account directly from your QNB account

Important notes:

- You can only link one PayPal account to your QNB account at a time

- If you need to change the linked PayPal account, you must first remove the current one before setting up a new one

- The minimum withdrawal amount is 18.20 QAR

- The maximum withdrawal amount is 10,000 QAR per transaction

- There is a daily withdrawal limit of 10,000 QAR

- Each withdrawal transaction incurs a fee of 15 QAR

By linking your QNB account with PayPal, you gain more flexibility in managing your online transactions and accessing your PayPal funds in Qatar.

Contacting PayPal

To contact PayPal customer service:

- Log in to your PayPal account

- Go to the Message Center

- Choose “Ask the PayPal Assistant”

- If the assistant can’t help, you can be transferred to a human agent

Alternatively, you can:

- Use the PayPal mobile app and tap on Message Center

- Visit the PayPal Contact Us page on their website

- Call PayPal customer service (hours are 8AM – 8PM CST daily)

Contacting QNB

To contact Qatar National Bank (QNB):

- Call the QNB customer service center at +974 4440 7777

- Visit a QNB branch in Qatar

- Use QNB’s online banking portal to send a secure message

- Contact QNB through their official social media channels

Frequently Asked Questions

- Can I use PayPal in Qatar without a bank account?

Yes, you can use PayPal with a linked credit or debit card, but withdrawals require a QNB bank account. - Is it safe to use PayPal in Qatar?

Yes, PayPal employs strong security measures to protect users’ financial information and transactions. - Can I receive payments from overseas using PayPal in Qatar?

Yes, you can receive international payments through your PayPal account in Qatar. - How long does it take to withdraw money from PayPal to a Qatari bank account?

Withdrawals to QNB accounts typically take 3-5 business days to process. - Can I use PayPal for business transactions in Qatar?

Yes, PayPal offers business accounts and merchant services for companies operating in Qatar.

Ammara Abdullah is an experienced writer and editor specializing in technology and digital trends. With over 5 years of experience, she produces insightful articles on emerging tech, consumer electronics, and digital culture. Ammara holds a degree in journalism and is passionate about making complex topics accessible to readers.